25 September 2025

A battle of the skies is playing out in Australia as Virgin increasingly mirrors Jetstar’s pricing in certain booking windows, according to new research.

A study led by the University of South Australia shows that while Virgin is matching Jetstar’s pricing 28-60 days out from booking, it is not as competitive for passengers who book less than 21 days before departure.

Researchers from UniSA and China analysed booking fare data from four of Australia’s busiest domestic routes: Sydney-Melbourne, Sydney-Brisbane, Sydney-Gold Coast and Brisbane-Melbourne.

The findings highlight a clear, three-tier hierarchy of fares: Qantas at the top, Jetstar at the bottom, and Virgin positioned in between.

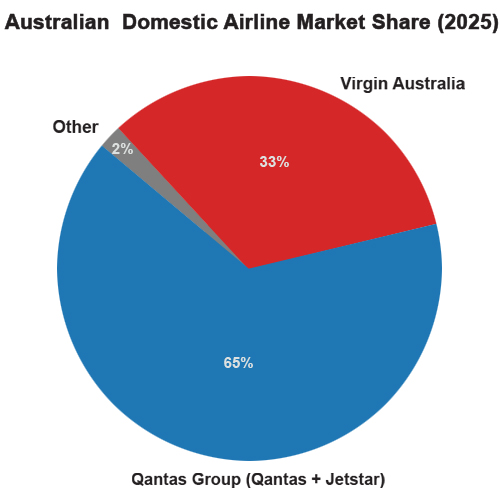

Jetstar – given substantial operational autonomy from its parent company Qantas – now has 33% market share of domestic travellers, helping Qantas to cement its 65% market dominance.

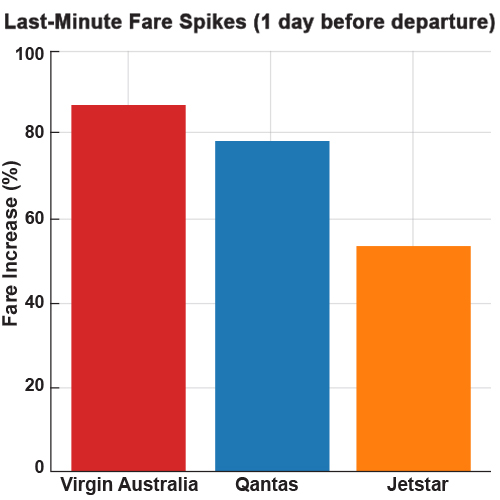

Lead researcher Professor Shane Zhang says that all three airlines use dynamic pricing, where fares climb steeply just before departure, hitting business travellers hardest.

Lead researcher Professor Shane Zhang says that all three airlines use dynamic pricing, where fares climb steeply just before departure, hitting business travellers hardest.

“Our research found that Virgin adopts a selective pricing response to Jetstar. For travellers booking early (28 to 60 days in advance), Virgin’s fares tend to shift closer to Jetstar’s,” Prof Zhang says.

“This reflects Virgin’s strategy to compete for price-sensitive early bookers by simplifying some services while still leveraging its full-service offerings – such as frequent flyer programs and business class options – for less price-sensitive travellers closer to departure.”

Conversely, in the short booking window (1-21 days) Virgin doesn’t try to match Jetstar’s fare movements, instead aligning with Qantas fares, focusing on loyalty and premium travellers.

“Virgin is walking a fine line between cost and service differentiation. It follows Jetstar just enough to remain competitive with budget-conscious travellers, but not so much that it dilutes the brand with higher-yield business customers.”

“Virgin is walking a fine line between cost and service differentiation. It follows Jetstar just enough to remain competitive with budget-conscious travellers, but not so much that it dilutes the brand with higher-yield business customers.”

The study underscores how the hybrid carrier model – sitting between full-service airlines and low-cost carriers – has become a strategic necessity for Virgin since its low-cost subsidiary Tiger was closed down in 2020 and it shifted its market focus from a full-service carrier to become a mid-tier airline.

Since restructuring, Virgin has regained around one third of domestic market share, making it a formidable rival to both Qantas and Jetstar.

However, the sharp fare hikes that each airline imposes close to departure reflects the limited competition in Australia’s skies.

“While not illegal, tacit collusion in Australia’s duopoly market is bad news for travellers, leading to inflated late-booking fares,” Prof Zhang says.

“It’s important that regulators monitor steep, last-minute fare hikes for signs of anti-competitive behaviour and misuse of market power.”

The researchers say that Qantas may need to reinforce its premium positioning as it faces a declining domestic market share, while granting Jetstar more autonomy to compete head-to-head with Virgin.

“We’re seeing the start of a more complex competition pattern,” Prof Zhang says. “Hybrid carriers are no longer just adapting to low-cost competition; they’re reshaping how fares are structured in the entire market.”

‘The impact of low-cost carriers on hybrid carriers: The case of the Australian domestic market’ is published in Research in Transportation Business and Management. It is authored by researchers from the University of South Australia and Capital University of Economics and Business, Beijing, China. DOI: 10.1016/j.rtbm.2025.101499

…………………………………………………………………………………………………………………………

Researcher contact: Professor Shane Zhang E: yahua.zhang@unisa.edu.au

Media contact: Candy Gibson M: +61 434 605 142 E: candy.gibson@unisa.edu.au